With Christmas just around the corner, employers are planning their Christmas party and Christmas gifts to employees.

With careful consideration given to Income Tax and Fringe Benefits Tax (FBT) law, employers may be able to successfully mitigate fringe benefits tax payable and / or gain an income tax deduction. The gift that keeps on giving!

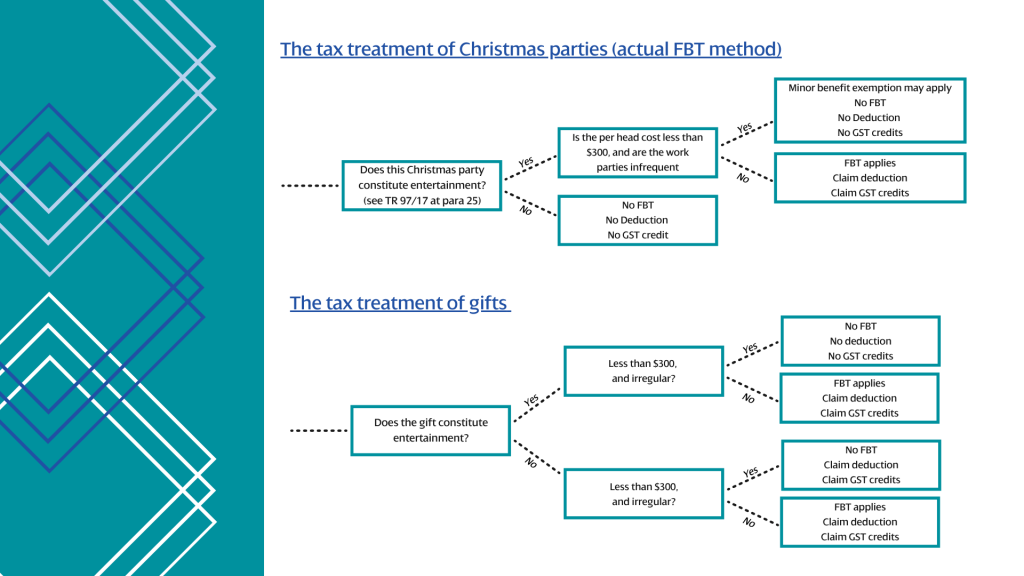

Below are some useful examples of what the FBT, Tax and GST implications may be in the particular circumstances. The below possibilities are based on the employers circumstances, so I recommend independent tax advice based on your situation.

CHRISTMAS GIFTS

Example 1: $250 Universal gift card or $250 MYER gift card given to employee

What type of gifts are these?

These items are considered “Non-entertainment gifts”. Other examples include, Christmas hampers, bottles of wine, bottle of perfume, gift vouchers, pen sets.

What is the value of the gifts and how often are they provided?

As the value of the gift is less than $300, the minor benefits exemption may be available. Further, as the gift is provided to the employee once a year, the ATO views this as irregular.

Outcome

Potentially no FBT Payable, Claim Income Tax Deduction and Claim GST credits (generally not applicable to gift cards though).

Example 2: Ticket to John Farnham farewell tour (value $250) or HOYTS $250 gift card or $250 Crown gift card given to employee

What type of gifts are these?

These items are considered ‘entertainment gifts’. Other examples include tickets to the movies, concerts, sporting events, holiday airline ticket.

What is the value of the gifts and how often are they provided?

As the value of the gift is less than $300, the minor benefits exemption may be available. Further, as the gift is provided to the employee once a year, the ATO views this as irregular.

Outcome

Potential No FBT Payable, No Tax Deduction, No GST credits to be claimed.

CHRISTMAS PARTIES

Example 1: $250 cost per employee, Christmas lunch at a restaurant with food and alcohol

What is the value of entertainment and how often is it provided?

As the value of the entertainment is less than $300, the minor benefits exemption may be available to exempt the entertainment gift from FBT if using the ‘actual method’.

Outcome

Potential No FBT Payable, No Tax Deduction, No GST credits to be claimed.

Example 2: $100 per employee, Christmas party held on the business premises

What is the value of entertainment and how often is it provided?

As the value of the entertainment is less than $300, the minor benefits exemption may be available to exempt the entertainment gift from FBT if using the ‘actual method’.

Outcome

Potential No FBT Payable, No Tax Deduction, No GST credits to be claimed.

Please contact Nathan Caccamo at MGI Parkinson for a discussion on how we can assist you.